Cook County Tax Reassessment of Barrington

Don’t overlook your property tax re-assessment notice and the deadline to appeal. The Assessor has released Barrington’s commercial and residential assessment reports for the 2019 tax triennial which can be found here:

http://www.cookcountyassessor.com/assets/forms/BarringtonCommercial.pdf

http://www.cookcountyassessor.com/assets/forms/BarringtonResidential.pdf

Based on the published valuation statistics, the Assessor believes that the median sale price of residential properties in Barrington are as follows: $560,000 in 2013; $660,500 in 2015; $529,000 in 2016; and, $548,250 in 2019. The Assessor used these changes in market value to support a median percentage change in the township’s overall residential assessment of 17.35% in 2016 and 1.0% in 2019.

Even though the Assessor posted the 2019 residential assessment neighborhood map, he focused on limited or cherry-picked data from 2017 to 2019 for Barrington’s sales trends. The following is a comparison of the Overall Median Sales and Median Percentage Change regarding residential assessed values between the 2016 and 2019 reassessment periods by neighborhood:

Neighborhood 11

$375,500 (2016) vs. $325,000 (2019). 11.99% (2016) vs. -13.0% (2019)

Neighborhood 12

$376,500 (2016) vs. $377,000 (2019). 12.45% (2016) vs. 8.0% (2019)

Neighborhood 14

$531,000 (2016) vs. $512,500 (2019). 12.37% (2016) vs. -3.0% (2019)

Neighborhood 21

$891,500 (2016) vs. $580,000 (2019). 14.0% (2016) vs. -3.0% (2019)

Neighborhood 22

$337,250 (2016) vs. $387,500 (2019). 23.89% (2016) vs. 7.0% (2019)

Neighborhood 23

$760,500 (2016) vs. $650,000 (2019). 20.14% (2016) vs. -6.0% (2019)

Neighborhood 24

$731,500 (2016) vs. $888,558 (2019). 19.31% (2016) vs. 4.0% (2019)

Neighborhood 25

$591,500 (2016) vs. $500,000 (2019). 17.92% (2016) vs. 44.0% (2019)

Neighborhood 30

$637,500 (2016) vs. $775,000 (2019). 19.83% (2016) vs. 5.0% (2019)

Neighborhood 31

$953,500 (2016) vs. $760,000 (2019). 24.67% (2016) vs. -5.0% (2019)

Neighborhood 40

$302,500 (2016) vs. $330,000 (2019). 14.71% (2016) vs. -2.0% (2019)

As the primary component of your real estate tax bill, your tax assessment continues to fluctuate and its reduction is critical in reducing your tax liability.

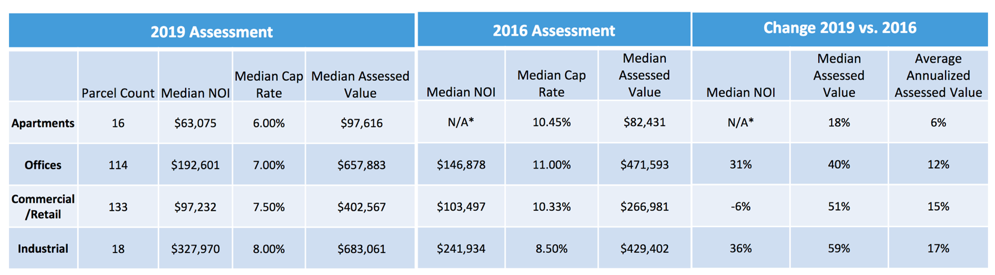

Regarding the apartment, commercial, industrial and office properties, the proposed changes in assessed values are summarized in the following excerpt from Page 11 the Assessor’s commercial report:

The Assessor has employed a computer assisted mass appraisal method that used data points from various opinions of value. Simply, the Assessor, from an investment perspective, focused on income and broad, unadjusted market data (Appendix A – Median Rents and Vacancy on Page 13) to materially lower the Cap Rates for all property types (Appendix B – Cap Rate Tables on Page 14) resulting in disparity as well as disproportionate changes in assessed values throughout the township as shown in the above excerpt.

Given the challenge of revaluing all properties in the North Suburbs and Cook County, it can be difficult for the Assessor to fully understand specific challenges facing your property since his office does not take the time to review nor make special considerations for your property’s unique aspects. Therefore, property owners and tenants should start by contacting our firm for a prompt review of the 2019 assessed value for the property taxes payable in 2020 and the remainder of the current triennial period.

Dimitrios P. Trivizas, Ltd., has successfully filed tax appeals, negotiated settlements and litigated tax complaints on a variety of properties ensuring real property tax savings and tax refunds for property owners and tenants across all Counties in Illinois.