Dimitrios P. Trivizas, Ltd.

Property Tax and Real Estate Lawyers

You will not be charged a fee unless your tax appeal is won

+1(312) 256-7333

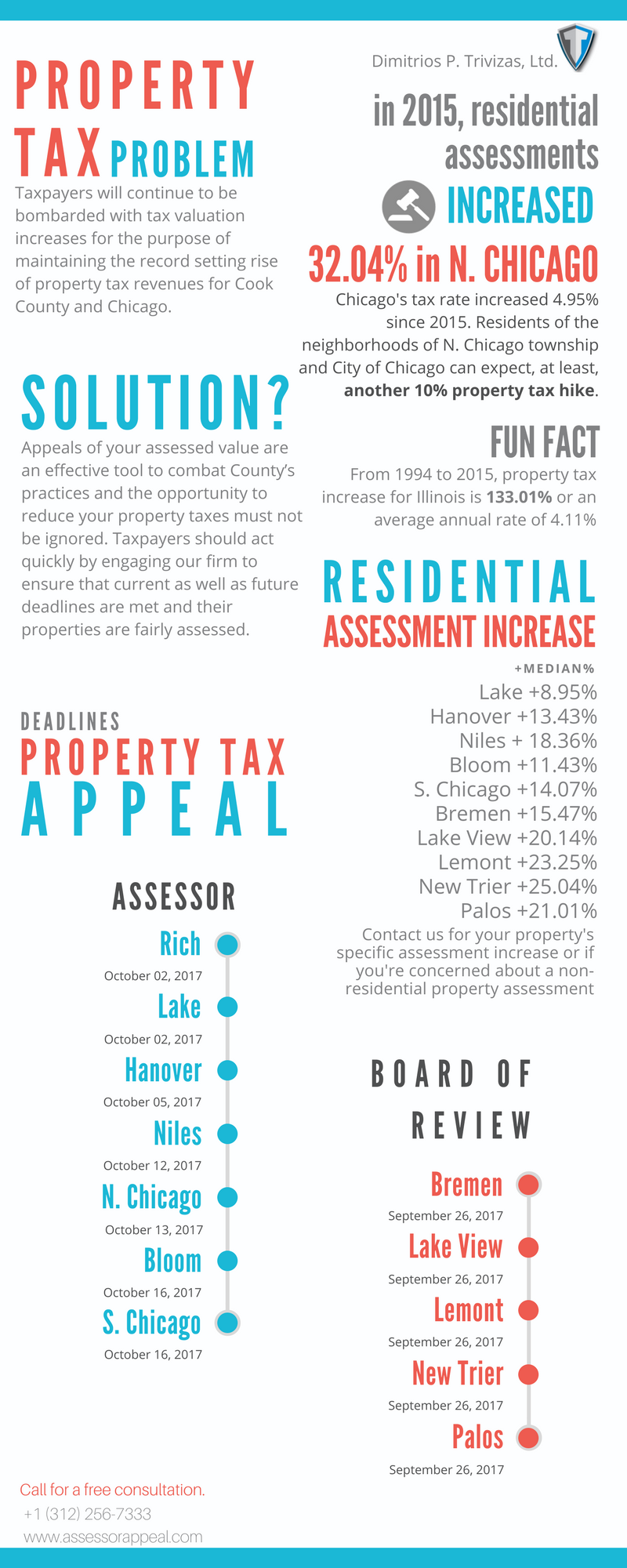

Property Tax Problem

Taxpayers will continue to be bombarded with tax valuation increases for the purpose of maintaining the record-setting rise of property tax revenues for Cook County and Chicago. Chicago’s tax rate increased 4.95% since 2015. Residents of the neighborhoods of N. Chicago township and the City of Chicago can expect, at least, another 10% property tax hike.

FUN FACT: From 1994 to 2015, property tax increase for Illinois is 133.01% or an average annual rate of 4.11%

Solution

Appeals of your assessed value are an effective tool to combat County’s practices and the opportunity to reduce your property taxes must not be ignored. Tax payers should act quickly by engaging our firm to ensure that current as well as future deadlines are met and their properties are fairly assessed.

Residential Assessment Increase (+Median%)

Lake +8.95%

Hanover +13.43%

Niles +18.36%

Bloom +11.43%

S. Chicago +14.07%

Bremen +15.47%

Lake View + 20.14%

Lemont +23.25%

New Trier +25.04%

Palos +21.01%

N. Chicago +32.04%

Contact us for your property’s specific assessment increase or if you’re concerned about a non-residential property assessment.

Property Tax Appeal Deadlines

ASSESSOR

Rich - 10.02.17

Lake - 10.02.17

Hanover - 10.05.17

Niles - 10.12.17

N. Chicago - 10.13.17

Bloom - 10.16.17

S. Chicago - 10.16.17

BOARD OF REVIEW

Bremen - 09.26.17

Lake View - 09.26.17

Lemont - 09.26.17

New Trier - 09.26.17

Palos - 09.26.17

FULL INFOGRAPHIC

Need More Info ?

As we specialize in property tax relief, tax incentives and zoning, contact us for a free consultation about your property.

References

Cook County Assessor’s Office Website (Appeal and Closing Deadlines): http://www.cookcountyassessor.com/Appeals/Appeal-Deadlines.aspx

Cook County Board of Review Website: https://www.cookcountyboardofreview.com/dates/filing-dates

Cook County Clerk Township Maps: http://www.cookcountyclerk.com/aboutus/map_room/Pages/TownshipMaps.aspx

Cook County Assessor’s Office Website Valuation Statistics: http://www.cookcountyassessor.com/Resources/Valuation-Statistics.aspx